08.11.2021

Was motiviert Bürger*innen in Deutschland, Energiedaten für die digitale Energiewende bereitzustellen? Welche Erwartungen haben sie an die datennutzenden Energieunternehmen? Eine WZGE-Studie gibt Antworten.

Digitale Innovationen im Energiesektor sind ein entscheidender Treiber für die Energiewende. Die Einführung solcher Technologien geht nicht nur mit wirtschaftlichen, technischen und rechtlichen Fragen einher. Es stellen sich auch ethische Herausforderungen: Digitale Innovationen benötigen Daten – und damit auch die Bereitschaft der Menschen, ihre Daten zu teilen. Beim Datenteilen entstehen jedoch zahlreiche Konflikte wie zum Beispiel zwischen dem individuellen Wunsch nach informationeller Selbstbestimmung und wirtschaftlichen Datenverwertungsinteressen. Daraus können Vertrauens- und Akzeptanzprobleme entstehen, die zu Kooperationsblockaden führen und die Energiewende ausbremsen.

Wie können wir dieses „Datendilemma“ überwinden? In unserer Studie Datenteilen für die digitale Energiewende. Ethische Orientierungen für Energieunternehmen haben wir im Zeitraum von April bis Mai 2021 zusammen mit dem Marktforschungsinstitut komma 1049 Bürger*innen gefragt, unter welchen Voraussetzungen sie bereit sind, ihre Energiedaten zu teilen. Die Studie ist Teil unseres Projekts zu den Ethischen Herausforderungen der digitalen Energiewende.

Die Kernergebnisse im Überblick:

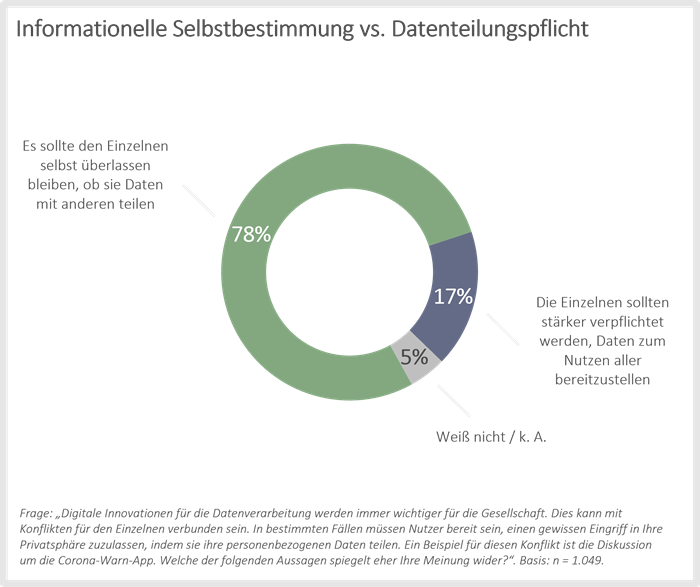

Große Skepsis gegenüber „Datenteilungspflicht“

Mehr als drei Viertel (78%) der Befragten wollen selbst darüber entscheiden, ob und wann sie ihre Daten teilen. Lediglich 17% plädieren dafür, den Einzelnen stärker in die Pflicht zu nehmen, Daten für gemeinwohldienliche Zwecke zur Verfügung zu stellen.

Wissens- und Informationsdefizite in Sachen digitale Energiewende

Das Wissen über die digitale Energiewende ist nach wie vor erstaunlich gering. 70% der Befragten bekunden großes Interesse an Energiethemen. Hinsichtlich (digitaler) Neuerungen fühlen sich jedoch nur 36% (eher) gut informiert. Dies zeigt sich auch in Sachen Smart Meter: Nur 14% kennen den Begriff, lediglich 9% sind mit der Funktionsweise von Smart Metern vertraut. Dabei zeigen sich auch zielgruppenspezifische Unterschiede. So ist etwa das Wissen zum Thema Smart Meter bei Menschen mit niedrigem Bildungsgrad deutlich geringer ausgeprägt.

Bedingte Datenteilbereitschaft für die digitale Energiewende

Gut zwei Drittel (68%) der Befragten können sich vorstellen, ihre Energieverbrauchsdaten via Smart Meter mit Energieunternehmen zu teilen. 25% lehnen eine Datenübermittlung (eher) ab. Dabei zeigt sich: Je positiver die Befragten die gesellschaftlichen Auswirkungen intelligenter Datennutzung einschätzen, umso höher ist auch ihre Bereitschaft, Energiedaten mit Energieunternehmen zu teilen. Umgekehrt haben Befragte mit geringerem Vertrauen in die datennutzenden Energieunternehmen grundsätzlich auch eine geringere Bereitschaft, ihre Energiedaten bereitzustellen.

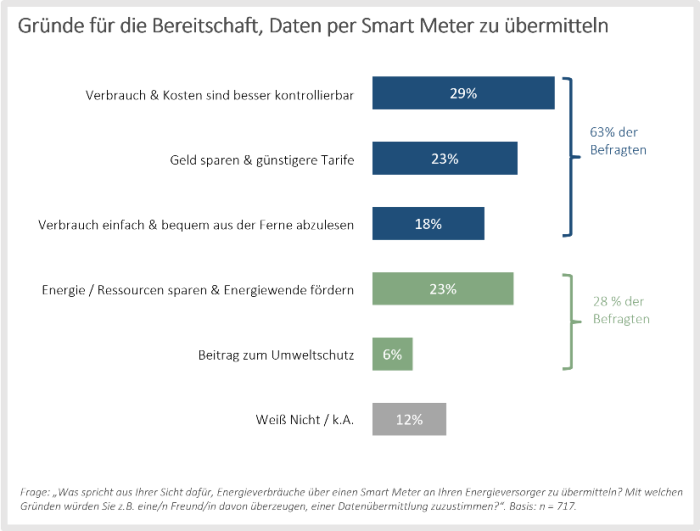

Persönlicher Nutzen als Triebkraft für Datenteilbereitschaft

Für 63% derjenigen, die (eher) bereit sind, ihre Energiedaten via Smart Meter zu teilen, stehen Nutzenaspekte, wie zum Beispiel geringere Energiekosten, im Vordergrund. Gemeinwohlbezogene Aspekte wie ein Beitrag für die Energiewende sind dagegen nur für 28% ein Anreiz, Daten per Smart Meter zu übermitteln.

Auch bei der weiter zugespitzten Frage nach dem wichtigsten Anreiz für das Teilen von Energiedaten mit Unternehmen steht der persönliche Nutzen an erster Stelle: Für 18% aller Befragten ist er der relevanteste Faktor – kein Aspekt wird häufiger genannt. Gemeinwohlbezogene Aspekte sind lediglich für 7% ausschlaggebend.

Vertrauen als Vorbedingung für Nutzenwahrnehmung

Auf die Frage, welche Gründe gegen das Datenteilen via Smart Meter sprechen, dominiert bei den Skeptiker*innen des Datenteilens die Sorge vor Schädigungen: 60% befürchten, dass ihre „häuslichen Gewohnheiten erfasst“ werden könnten. 51% äußern zudem Bedenken, die datenverwertenden Unternehmen könnten mehr von den Daten profitieren als sie selbst.

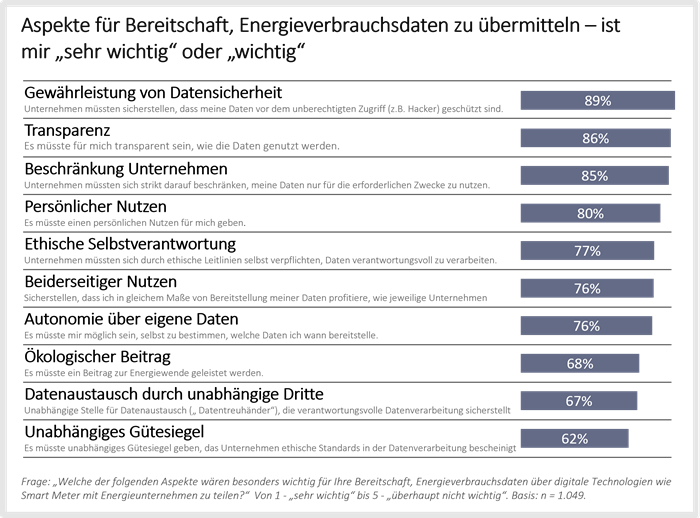

Fragt man umgekehrt nach der Bedeutsamkeit vertrauensbildender Faktoren für das Datenteilen mit Energieunternehmen, zeigt sich folgendes Bild: Mit 89% wird von den Befragten die Gewährleistung von Datensicherheit am häufigsten als (sehr) wichtiger Faktor genannt. Dicht dahinter folgen Transparenz der Datenverarbeitung (86%) und eine strikte Zweckbindung der Datennutzung der Energieunternehmen (85%). Die Gewährleistung von Datensouveränität ist insbesondere für Menschen mit geringer Datenteilbereitschaft von großer Relevanz. Für 29% aus dieser Gruppe ist dies der allerwichtigste Faktor für ihre Datenteilbereitschaft (gegenüber 14% bei der Gesamtheit der Befragten).

Überraschend: Der vieldiskutierte Einsatz von Datentreuhändern und Gütesiegeln als vertrauensbildende Faktoren nimmt für die Befragten eine untergeordnete Rolle ein und ist lediglich für 68% bzw. 62% (sehr) wichtig. Die Selbstverantwortung der Unternehmen in Form von ethischen Leitlinien wird dagegen von 77% als (sehr) wichtig erachtet.

Ethische Orientierungen für Energieunternehmen

Die Ergebnisse zeigen: Gerade Unternehmen können beim Datenteilen für die Energiewende den Faktor Vertrauen entscheidend mitbeeinflussen. Wir haben vier Orientierungen für konkrete vertrauensbildende Investitionen herausgearbeitet. Mehr dazu in der Studie, die Sie hier herunterladen können.

[Download der WZGE-Studie: Datenteilen für die digitale Energiewende]